As we become a more distributed economy where businesses have employees and contractors all around the world, the need for platforms that allow fast onboarding and payments while adhering to local laws and regulations is increasing.

The challenges businesses face in this field are extensive and varied — but not impossible to overcome with the right partner. So how can businesses pick the right partner in setting up and managing an international payroll? We asked the experts.

Onboarding and payment challenges

As well as complexities with legal and compliance, payment challenges include facilitating payments quickly and in real-time — in the local currency of the person you are paying.

“The main things that a company needs to think about as it grows internationally are the laws and regulations that apply to onboarding and paying people in each and every country that they plan to hire,” says Robin Gandhi, chief product officer at Nium, a global payments provider supporting payroll platform providers with collections, treasury management and disbursement services.

Global payroll platforms remove a lot of those challenges for companies who want to grow

“For example, this could include the requirements around setting up a local entity to properly file taxes based on the circumstances of each worker.”

Gandhi notes that if you’re a company based in multiple locations without legal and tax professionals who know each market, it can be a daunting task to get this right — especially if you’re not hiring a lot of people in each of those countries.

“Global payroll platforms remove a lot of those challenges for companies who want to grow,” he says. “These platforms are doing this at scale for many companies at the same time, so they know the nuances of every market and can get a company into a market really fast while ensuring they are following all laws.”

Picking a model

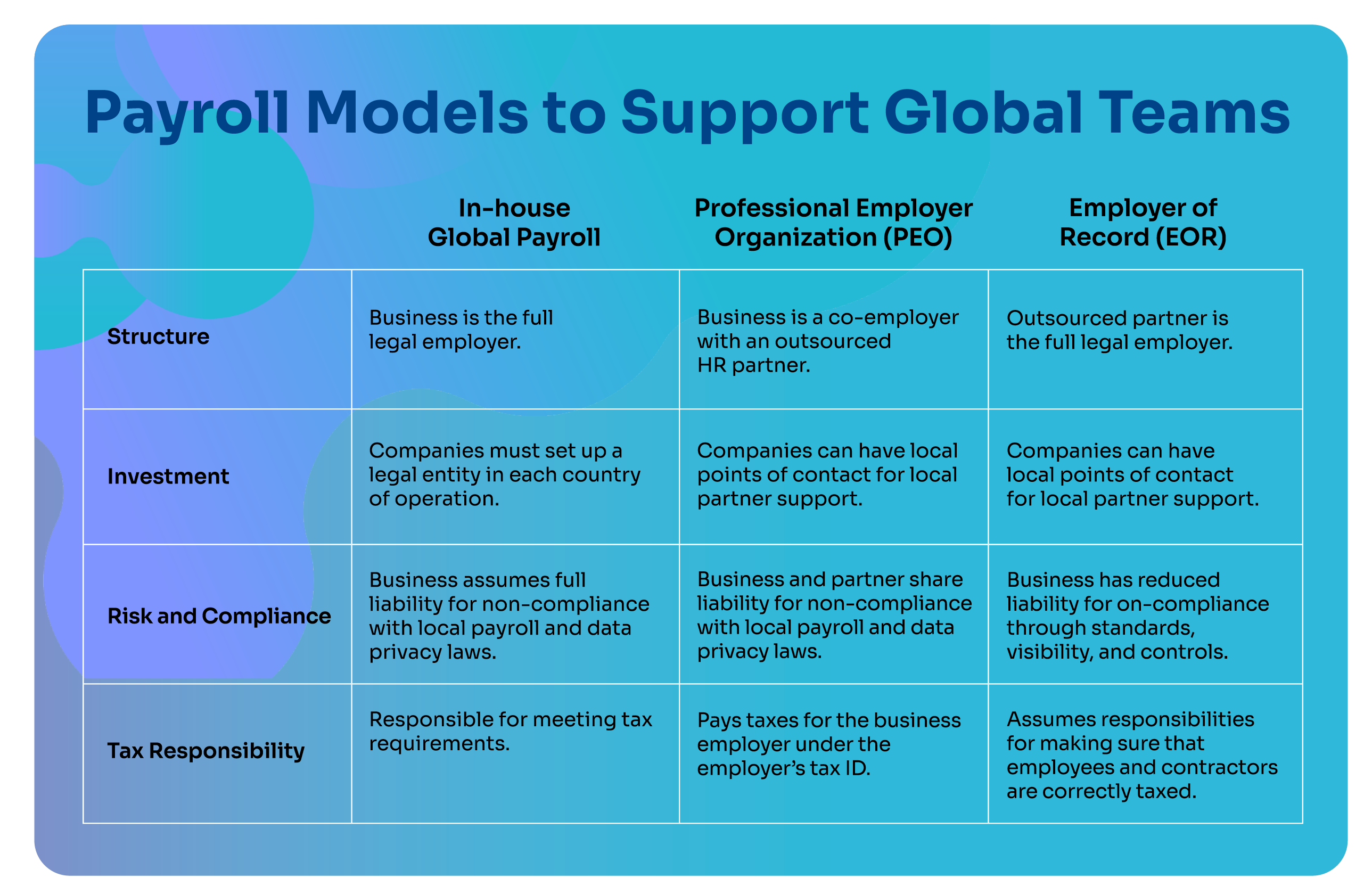

Two typical global payroll models can help overcome these challenges quickly: Professional Employer Organisations (PEOs) and Employer of Records (EORs).

PEOs help manage employees or contractors around the world by acting as a co-employer where the company would need a local entity in every region in which they want to hire. EORs do everything that a PEO does — and also act as the legal employer of record so that the company doesn't need to even have an entity in a certain market.

In addition to solving the payroll problem for global companies, PEOs and EORs also typically provide tools to manage the overall employee or contractor lifecycle with added HR services such as health benefits, life insurance and retirement plans.

“Global payment platforms allow payroll platforms like PEOs and EORs to grow quickly,” says Gandhi. “They allow these platforms to serve their underlying customers by providing a way to pay employees and contractors on time and in a way the employee prefers, and by ensuring that payments are made while following the rules and regulations of that country or region.”

Serving the customer

Albert Owusu-Asare is cofounder and CEO at Cadana, a payroll platform that allows companies to pay salaries across Africa. He believes that along with having the operational know-how, it’s essential for platforms in this field to give users a great customer experience.

[When choosing a partner], you definitely want one who understands the nuances

“If you're in Africa and it's taking two to nine business days for a contractor to get their pay, that's a very bad experience compared to someone in, say, the UK,” says Owusu-Asare. “The talent's experience is going to start mattering more — and payroll providers will have to really keep that in mind.”

Owusu-Asare says a key role of platforms like Cadana is to create a borderless world, when in reality, borders and jurisdictions are the key challenges.

“[When choosing a partner], you definitely want one who understands the nuances,” he says. “The way that you might hire a contractor in a place like France might not be the same as somewhere like South Africa, so you really want to have the business demonstrate any actual experience they have in a certain market.”

Owusu-Asare believes it’s also important to understand to what extent a business owns its infrastructure and what they are doing internally before signing a partnership contract. That answer, he says, would allow you to know what the operational efficiencies could be.

“Get a clear understanding of the countries they reach,” he adds. “You wouldn't want a partner that only has reach in certain parts of the world — if you start hiring from elsewhere, you'd end up having to find another payroll provider.”

Operating together

Global B2B payments providers, like Nium, can provide the infrastructure for global payroll providers to jump into action.

A good payments partner should have the ability for a customer of a global payroll and workforce management platform like Cadana to send money into a virtual account in their preferred currency before payroll is due

“A good payments partner should have the ability for a customer of a global payroll and workforce management platform like Cadana to send money into a virtual account in their preferred currency before payroll is due,” says Gandhi. “And ideally, the provider can also screen the person who is going to receive the money along with the amount that they are set to receive to ensure that they are not going to be flagged for any suspicious activity when payroll is due.

“Payroll platforms need to think about providing a choice to how they send money for payroll. This means having flexibility to send money to these workers in the form factor they prefer, whether it is their bank account, their preferred mobile wallet or even to an existing Visa or Mastercard so that they can access funds quickly and spend to meet the needs of their lives.”

To learn more about how Nium could support your business, click here.